Behind The Smiles: Why Banks Aren’t Your Friend and How They Profit At Your Expense

Kenyan banks may not be the loyal companions you think they are. While the personable banker who treats you to lunch might seem friendly, they likely have little control over crucial decisions, such as loan approvals or account management.

These determinations typically fall to higher-ups in distant offices, who view customers as mere numbers awaiting assessment. In the eyes of banks, you’re not a valued relationship but rather a file on a desk, easily discarded if deemed inconvenient.

Even if you’ve been a model customer for years, one misstep could sever the tie. Your loyalty means little if the higher-ups have had a rough week. It’s akin to being offered an umbrella only to have it snatched away at the first hint of rain.

While banks are indispensable for short-term financial needs and major projects, it’s unwise to entrust all your financial affairs to a single institution. Mixing long-term investments or loans with short-term financing spells trouble.

Separate your home mortgage from personal banking, and keep business borrowings distinct from personal accounts. Diversifying across institutions can shield you from the cascading consequences of a single bank’s misfortune.

When you walk into a bank, you might be greeted by smiling faces and warm handshakes, but don’t let that fool you. Despite the facade of friendliness, banks are not your friends. Here’s why:

- Profit-Driven Agenda: At the core of every bank’s operation is profit. While they may tout customer satisfaction and community involvement, the bottom line always comes first. Banks exist to make money, whether it’s through interest on loans, fees for services, or investment returns. Your financial well-being is secondary to their profit margins.

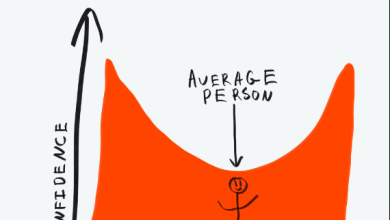

- Transactional Relationships: Sure, your banker might remember your name and ask about your family, but don’t mistake this for genuine friendship. Banks cultivate a facade of personal connection to retain customers and attract new ones. But behind the smiles and small talk lies a transactional relationship where your value is measured by your account balance and borrowing potential.

- Limited Loyalty: Being a loyal customer doesn’t guarantee special treatment or preferential rates. Banks are quick to raise fees, lower interest rates on savings, or deny loan applications, regardless of how long you’ve been with them. Loyalty is a one-way street in the banking world, where customers are expendable if they don’t serve the institution’s financial interests.

- Hidden Fees and Fine Print: Ever read the fine print on your bank statements or loan agreements? If not, you’re likely missing out on the myriad of fees and charges banks sneakily impose. From overdraft fees to maintenance charges, banks have a knack for nickel-and-diming customers without their knowledge or consent. These hidden fees can eat away at your savings and erode trust in the banking system.

- Risky Business: Banks operate in a high-stakes environment where risks are inevitable. Whether it’s reckless lending practices, speculative investments, or financial market volatility, banks prioritize their own stability over the well-being of their customers. When push comes to shove, banks will prioritize protecting their assets, even if it means leaving customers in the lurch.

While banks may present themselves as friendly allies in your financial journey, the reality is far from it. Behind the polished veneer lies a profit-driven entity that prioritizes its own interests above all else. So the next time you interact with your bank, remember: they’re not your friends, they’re just another business looking out for their bottom line.