Simplest Way You Can Clear Yourself From CRB

Credit Reference Bureaus (CRBs) are organizations that collect data from lending institutions such as banks, Microfinance Institutions, SACCOs, etc, about borrowers.

This data includes a borrower’s loans, when the loan was taken, how long it has taken them to repay, whether they paid on time, and so on. This information helps lenders as they review borrowers on a continuous basis, and helps them determine whether or not to issue a loan.

Even though this was a huge step for Kenya, a majority of Kenyans have been complaining that the CRB system is being used against them. Many believe that they are on CRB even though they don’t know how they got there.

READ MORE: Africa’s Cryptocurrency Market Grow By 1200% Despite Bear Market

Take for example Senior Counsel Philip Murgor who recently threatened to sue the NCBA Bank Group for listing him on CRB.

Murgor alleges that he has been erroneously listed on CRB for failing to clear a Sh. 1,300 loan which he has never taken.

That brings us to our topic today; How do you clear your name when listed on CRB?

How To Check if You Are Blacklisted by CRB

How to check CRB status on TransUnion

To check CRB status on TransUnion, you first need to pay a registration fee of Ksh50 through TransUnion’s pay bill number 212121, enter your ID number as the account name then proceed with the following steps:

1. Send your full name to 21272 (SMS costs Ksh19) or register on TransUnion Nipashe App available on Google Play Store or Apple Store.

2. Enter your ID number in the popup menu

3. Choose ‘CC’ indicating credit status

4. Send

You will receive your credit status via SMS. It will either be positive or negative, depending on your lending history.

READ MORE: Ruto Plans To Shift Boda Boda Riders From Gambling To Trading On NSE

How to check CRB status on Metropol

Metropol offers its CRB services through its website, USSD, and Metropol Crystobol app available on digital platforms; Google Play Store and Apple Store.

Their services include obtaining credit reports, CRB status, and clearance certificates. Here is how to check your CRB status on Metropol:

1. Pay Ksh50 via their pay bill number 220388 and enter your ID number as the account name.

2. You will receive an SMS with a unique PIN, a link, and a reference number.

3. Dial *433# and enter the unique PIN to receive your CRB status via SMS. Alternatively, you can visit the sent link and log in using the PIN to check your CRB status on their website.

How to check CRB status on CreditInfo

Credit info purely offers its CRB services online. Your CRB status will be sent to you with your credit report upon following these procedures:

1. Visit https://ke.creditinfo.com/credit-report-requests/

2. Enter your personal information to register – full names, ID number, phone number, and email

3. Confirm their terms and conditions

4. Upload a clear photo of your ID

5. State the reason for obtaining your credit report

6. Submit

You will be asked to pay a registration fee of Ksh50 before receiving your credit report.

READ MORE: World’s Largest Crypto Exchange Hit By $570 Million Hack

How To Remove Yourself from CRB

A bank loan or loans from mobile money lenders have haunted you for a long time now, and you have failed to pay it because your pockets are dry. Beating the 90-day notice from the bank or 30-day notice from digital lending platforms have proved impossible, and you have found yourself negatively listed on CRB due to a defaulted loan.

A negative listing has prevented you from taking a job or securing a mortgage, and you are asking yourself, how can I clear my name from CRB? Here is a step by step guide on how you can remove your name from CRB blacklist.

1. Check your CRB status through CRBs; TransUnion, Metropol or CreditInfo

2. You will receive your credit report with lending history and financial institutions that forwarded your details for CRB blacklisting

3. Note down the financial institutions that you failed to repay their loans

4. Make full payments so that your borrower’s account reads zero balance

5. Wait for three days for the institution to clear your loan on their records and send the information to CRB

6. Check your CRB status again. You will have cleared your name if the transactions were successful

How Long Does it Take To Be Cleared from CRB?

When you are negatively listed on CRB, and you pay all your outstanding loans, the respective financial institution will update the CRB on your repayment, and CRB will clear you within 1 to 3 days. At this point, you qualify to receive a CRB certificate of clearance.

How Much Does it Cost To Clear Your Name from CRB?

Clearing your name on CRB is free of charge. However, you need to visit the institutions that asked CRB to negatively list you because you defaulted on a loan. For the institutions to give CRB a go-ahead to clear your name, you have to repay the loans that you owe those financial institutions.

How To Get Your CRB Clearance Certificate

READ MORE: 3 Places You Should Be Very Careful When Picking Financial Advice

CRB clearance certificate is an important tool for knowing how an employee manages funds. Holding a clearance certificate means that you have cleared all your non-performing loans or you have a good credit history.

Today, employers ask CRB clearance certificate as one of the documents you need to submit with your job application forms. Failure to provide it will automatically disqualify you from bagging the employment, and you will never make it to the boardroom for an interview. So how do you get a CRB certificate of clearance in Kenya?

How to get CRB certificate of clearance on TransUnion

1. Send your full name to 21272 (SMS costs Ksh19) or register on TransUnion Nipashe App available on Google Play Store or Apple Store.

2. Pay a registration fee of Ksh50 through TransUnion’s pay bill number 212121

3. Pay Ksh2,200 on the same pay bill number (212121)

4. Copy the transaction message and mail it to cert@transunion.co.ke

5. You will receive a CRB certificate of clearance in your mailbox

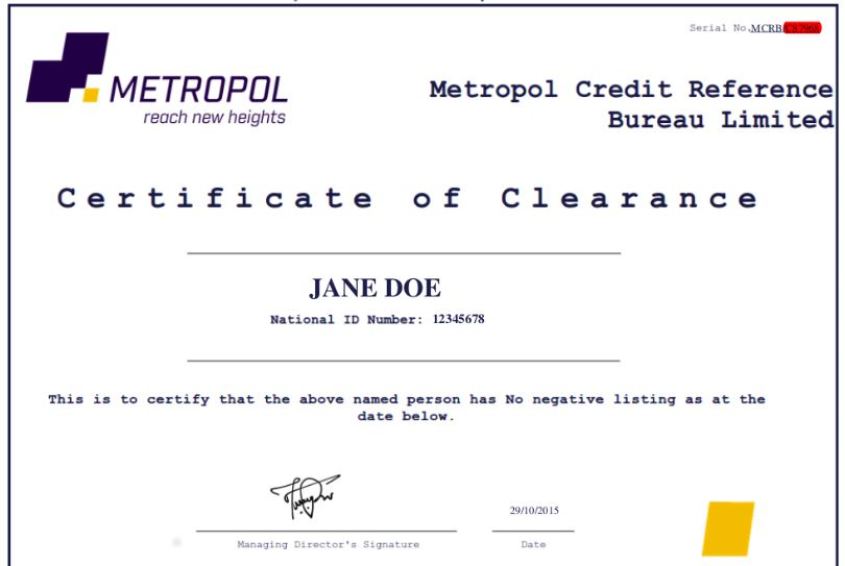

How to get CRB certificate of clearance on Metropol

1. Pay Ksh50 via their pay bill number 220388 and enter your ID number as the account name.

2. You will receive an SMS with a unique PIN, a link, and a reference number.

3. Click on the link that will direct you to the Metropol website

4. Enter PIN to log in

5. Choose ‘Clearance Certificate’ as displayed on the homepage

6. Pay Ksh2,200 that will automatically reflect on your Metropol account, and the CRB certificate will be available for download.

7. Download your CRB clearance certificate

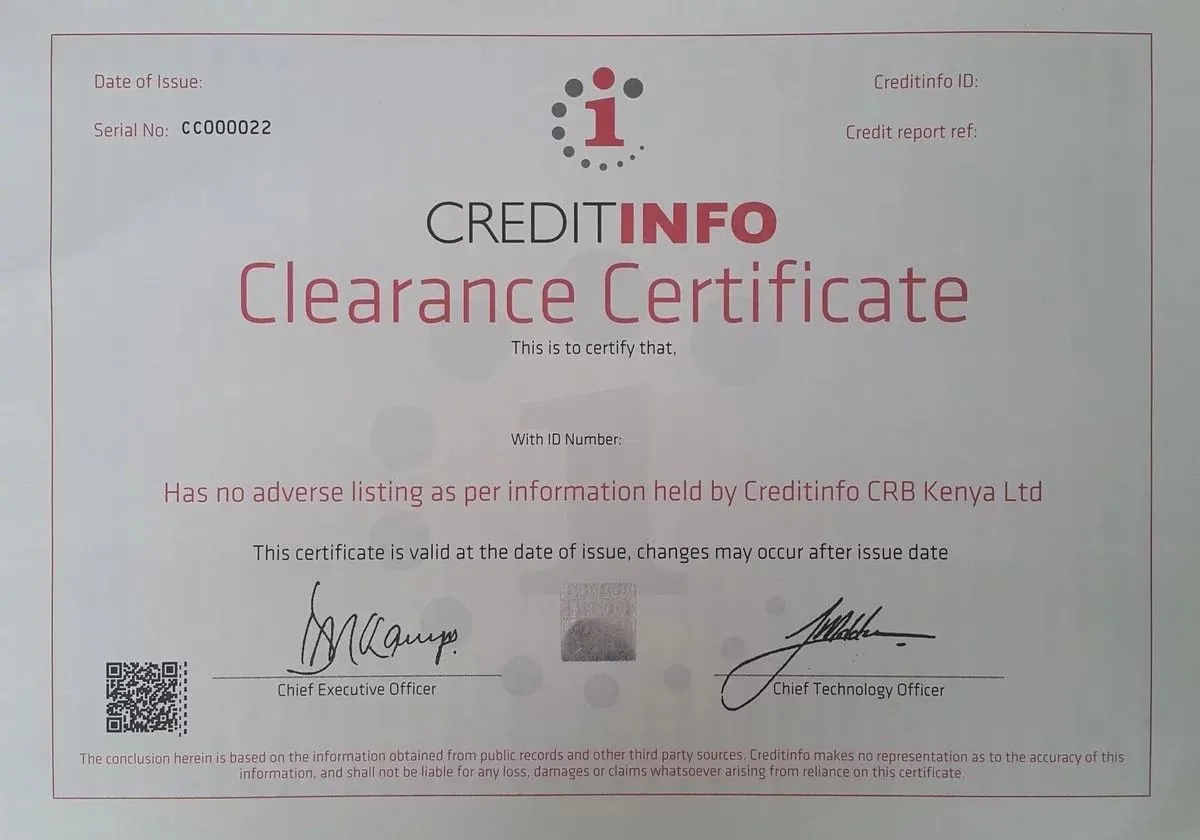

How to get CRB clearance certificate on CreditInfo

1. Visit https://ke.creditinfo.com/clearance-certificate-apply-now/

2. Enter your personal information to register – full names, ID number, phone number, and email

3. Confirm their terms and conditions

4. Upload a clear photo of your ID

5. State the reason for obtaining your CRB clearance certificate

6. Submit

7. Pay Ksh2,200

8. You will receive CRB certificate of clearance on the email you used to register on CreditInfo

How To Know if You Were Listed Wrongly on CRB

To know if you are wrongfully listed on CRB, you must first apply for a credit report with either TransUnion, Metropol, or CreditInfo. You will then scrutinize the credit report to see institutions that have wrongfully listed you, then contact the respective loan facilities to aid in clearing your name by sending updated information to CRB. You should also file a dispute notice with the CRB you inquired about erroneous listing.

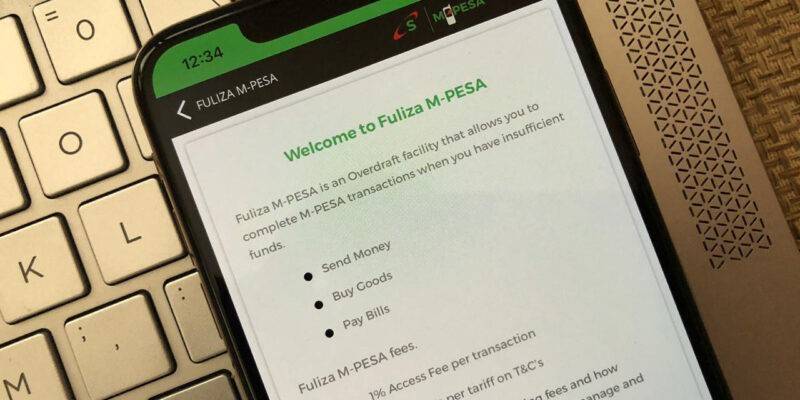

Can Fuliza Take You To CRB?

Safaricom Fuliza is an overdraft credit facility that allows Mpesa customers to transact even when their account balance is zero. It was founded by Safaricom in partnership with KCB and NCBA bank in 2019.

READ MORE: Want To Investing In Forex? Expert Sylvia Muchai Shares How She Lost Her Money And Bounced Back

Fuliza loan limits are set based on the customer’s credit viability. After getting a loan, you will be charged a one-off administrative fee of 1.083 percent and daily interests for a span of a month, depending on the money you borrowed. But what if you fail to pay back the Fuliza loan? Can Fuliza take you to CRB? Yes! Failure to pay the Fuliza loan within 120 days from the disbursement date will automatically lead to a negative listing on CRB.

Do Saccos Check CRB Status?

No, you can only check your CRB status with CRBs, which are licensed by the Central Bank of Kenya. However, Saccos can check the individual CRB status of only its consumers as part of knowing their credit worthiness. Saccos were given powers to access the Credit Information Sharing System (CIS) by CBK in 2020.

Do Saccos List You on CRB?

Through Gazette Notice No. 55 of April 8, 2020, of the Credit Reference Bureau Regulations, 2020 (CRB Regulations), Saccos were permitted to forward borrowers’ information to CRBs as well as receive credit reports directly from them. This means that Sacco loan consumers can now be listed on CRB if they default a loan.

Can I Get a Loan When Listed on CRB?

Yes, you can get a loan when you are negatively listed on CRB, but only in institutions that don’t ask you for a CRB certificate of clearance as among the requirements in the loan application. One known facility is Mwananchi Credit Limited.