Just because someone or a platform is dishing out financial advice doesn’t mean it’s correct.

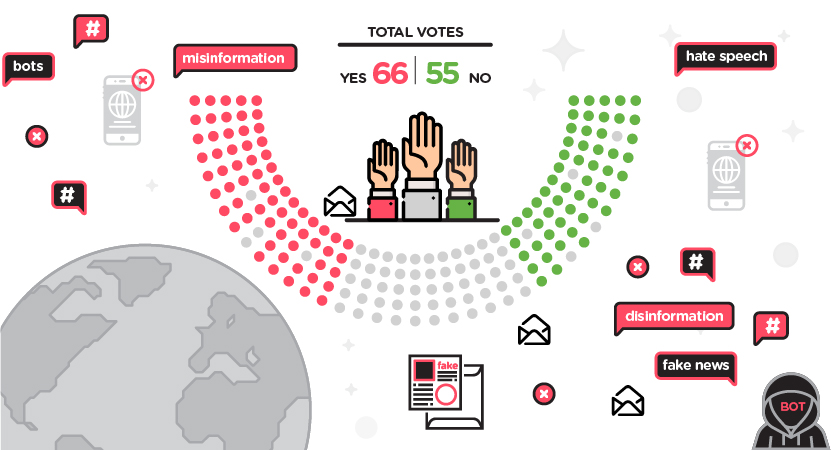

In this information age we are currently in, one of the biggest problems we are having is diffusing the truth from lies.

Below are 3 places where you need to take every financial information shared with a pinch of salt.

READ MORE: Chapa Luku Kwanza! 6 Ways Celebs And Socialites Mislead you Financially

1. Social Media

This largely involves Tik Tok.

TikTok isn’t just about viral dance videos. It has quickly become a popular resource for personal finance advice — but unfortunately, not all of it is good.

While there are some legitimate money experts on the app, there is a lot of financial advice floating around on TikTok that is misleading or just plain wrong.

READ MORE: Why Over 1.8M Kenyans Have Stopped Saving In Saccos

The best and worst thing about TikTok is that complex topics can be broken down into easy-to-understand videos that are usually less than 60 seconds long.

A lot gets changed in between and information twisted into something else.

Personal finance TikTok, also known as #FinTok or #StockTok, has misled youths into believing financial myths, scams, and dangerously misleading information.

READ MORE: Cost Of Living In Kenya Highest In 5 Years, Here’s how You can Manoeuvre

2. Media

Fake news is very real in today’s media landscape. Researchers have discovered that false stories on financial websites can actually sway stock markets one way or another and impact trading levels.

Media also has misled the masses time and time again into making wrong investments by promoting dead businesses, stocks and shell companies.

Don’t trust just any financial advice because it’s on TV or radio. This doesn’t necessarily mean it’s correct.

READ MORE: Cost Of Living In Kenya Highest In 5 Years, Here’s how You can ManoeuvreSeptember 1, 2022

3. Commercials, Sponsorships and Endorsements

Anything promoted is done so to benefit someone. Therefore any financial opportunities being sold to you be celebrities or most of these financial companies/experts are meant to benefit someone else and not just you in general.

Ask yourself: Does the company behind the message have an incentive for pushing this information? Does the author provide good evidence? Is the data presented in context? Does the author prove his work and show how he came to his conclusion?

Don’t just dive in blindly because it has been advertised.