Dangers Of Investing Too Much Money In Fixed Assets

What is a fixed asset?

Fixed assets refer to long-term tangible assets that are used in the operations of a business.

They provide long-term financial benefits, have a useful life of more than one year, and are classified as property, plant, and equipment (PP&E) on the balance sheet.

In short, Fixed assets are assets that last for more than a financial year. Assets that are held within the enterprises for future benefits.

READ MORE: Save Money In Money Markets or Savings Account?

A good example includes; buildings, computer equipment, software, furniture, land, machinery, and vehicles.

Fixed assets lose value as they age.

So there are dangers in over-investing in them.

READ MORE: Employment 101: Why You Haven’t Gotten A Salary Raise

Key Characteristics of a Fixed Asset

1. They have a useful life of more than one year

Fixed assets are non-current assets that have a useful life of more than one year and appear on a company’s balance sheet as property, plant, and equipment (PP&E).

2. They depreciate

With the exception of land, fixed assets are depreciated to reflect the wear and tear of using the fixed asset.

3. They are used in business operations and provide a long-term financial benefit

Fixed assets are used by the company to produce goods and services and generate revenue. They are not sold to customers or held for investment purposes.

READ MORE: Poleni! At least 80,000 Bitcoin Millionaires Wiped By Crypto Crash

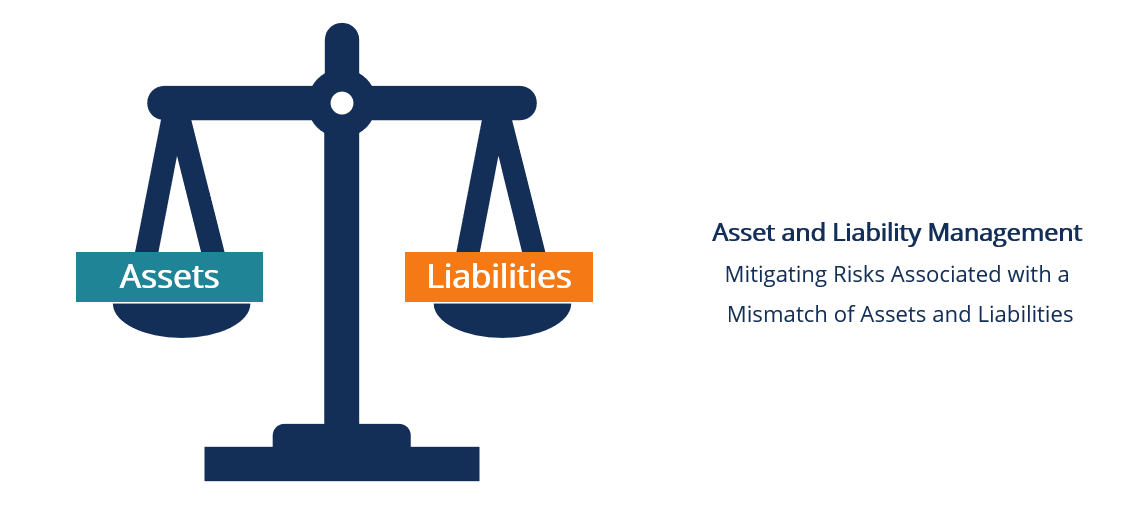

4. They are illiquid

Fixed assets are non-current assets on a company’s balance sheet and cannot be easily converted into cash.

Now that we know what fixed assets are, it’s good we understand the dangers that they come with.

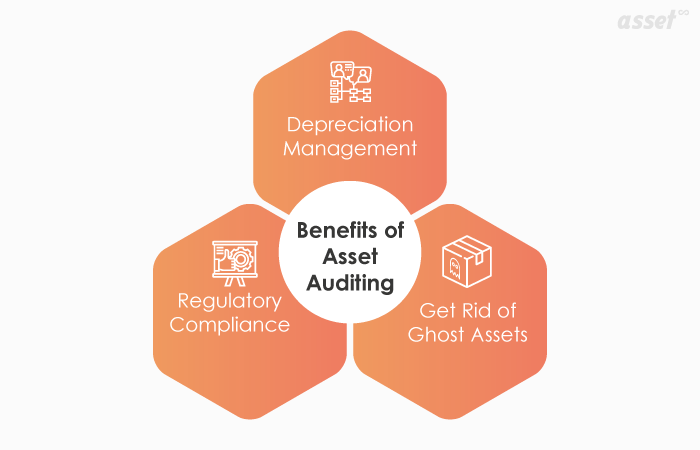

Data corruption in financial reporting(Fixed Asset Accounting)

The cases when there is depreciation on items that can not be amortized objects on conservation; objects that need to be written off (stolen, etc.), but are not there lead to misleading data. As a result expenses of the period are overstated and it leads to data corruption in financial reporting.

Depreciation

Companies can lose a lot of money through overinvesting in assets that depreciate.

The majority of fixed assets will decrease in value simply because they get old and don’t work as efficiently or stopped working altogether.

The only fixed asset that will not depreciate is land because it does not have a limited useful life.