2022 Week 29: Market Cap Training Summary

Here is the summary of the market in Kenya in week 29.

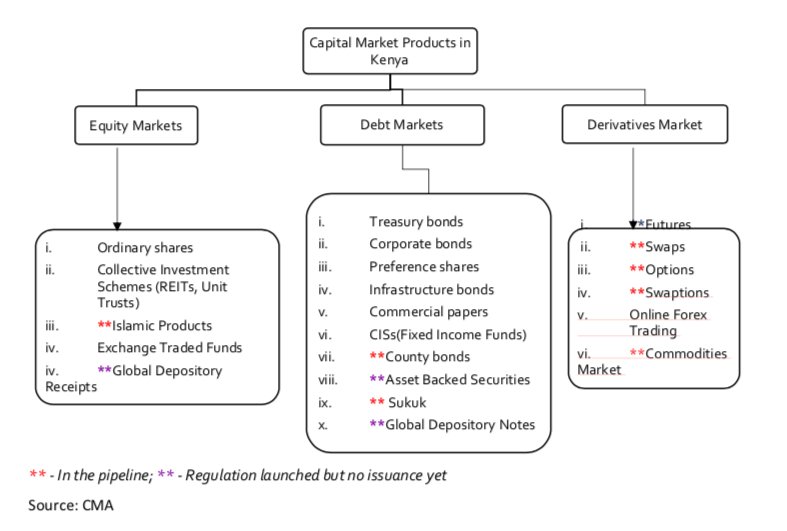

Equity Markets

- The all-inclusive NASI share price index decreased by 4.05% from 142.33 to 136.57 during the week ending July 22.

- The NSE 20 share price index decreased by 0.36% from 1682.49 to 1676.51 during the week ending July 22.

- The NSE 25 share price index decreased marginally by 1.95% from 3213.80 to 3151.28 during the week ending July 22.

- Market capitalization remained constant at KES Sh2.218 trillion in the week ended July 22. This was in line with NASI index that tracks the performance of the whole market. It is worthy to note that Safaricom Plc market capitalization (Ksh 1.162 trillion) currently accounts for 52.39% of NSE market capitalization.

- Volume of shares traded remained constant to close the week at 53.00 million, same as 53.00 million recorded in the previous week.

- Equity turnover increased by 38.46 per cent to Kshs 1.80 billion for week ended July 22 compared to KES 1.30 billion in the preceding week. Year-to-date shares worth Kshs 56.66 billion have been traded in the Nairobi Securities Exchange. It’s worthy to note that the NSE Plc makes 0.24% of equity turnover as equity trading fees which accounts for over 58% of its total income.

Corporate Announcements And Key Events

In the Treasury bills auction of July 21, the government sought to raise KSh 24 billion but received bids totalling Ksh 25.39 billion representing a performance of 105.77%

There is a preference by investors for the short-term 91-Day Treasury bill paper which registered performance of 388.35% which is indicative of an expectation of an increase in interest rates.

The interest rate on 91-Day Treasury bill, 182-Day Treasury Bill and 364-Day Treasury bill was 8.322%, 9.393% and 9.968% respectively.

- The bond market reported increased activity with bonds worth KES 14.90Bn transacted compared to KES 7.00Bn registered the previous week.

- The government raised KES 10.75B from reopened bond FXD2/2013/15 (5.8 years) and FXD2/2018/15 (11.3 years) which had aimed to raise KES 40B for budgetary support representing a performance rate of 26.43%. The coupon rate on FXD2/2013/15 and FXD2/2018/15 was 13.214% and 13.888% respectively.

- The Federal Reserve Bank USA hiked its bench mark rate by 0.75% in 15 June 2022. This is negative for shares as it leads to the contraction of multiples by which they had been trading previously. Its benchmark rate now lies between1.50% to 1.75%. Next FOMC meeting will be on 24/25 July 2022.

- Inflation in the United States increased by 9.1% for the month of June 2022 as compared to 7.8% inflation rate reported for the month of May 2022. This is the largest increase in inflation reported in the last forty one years. This inevitably means that the Fed will have to hike rates aggressively to stem the increase in inflation moving forward.

- June 2022 inflation came in at 7.90% compared to 7.10% in May 2022. (KNBS). This is the first time inflation has exceeded the upper target limit of 7.5% for inflation. Moving forward, you’d expect the Central Bank to take action to tame inflation by hiking interest rates to slow down aggregate demand and thus cool down inflation.

- The Kenyan GDP grew at a rate of 6.8 percent in the first quarter of 2022 compared to a growth of 2.7 percent in the first quarter of 2021. Growth was supported mainly by a significant recovery in sectors like Transportation and storage (8.1%), Accommodation and Food Serving services (56.2%), Professional, Administrative and Support Services (14.9%) and other service activities (11.1%). Only the agricultural sector, recorded a contraction of economic activities in the first quarter of 2022.

| FIRST QUARTER | GDP GROWTH RATE% |

| 2018 | 5.2% |

| 2019 | 4.8% |

| 2020 | 4.4% |

| 2021 | 2.7% |

| 2022 | 6.8% |

- Inflation eased from an average of 5.79 per cent in the first quarter of 2021 to 5.34% in the first quarter of 2022. The Central Bank Rate was retained constant at 7% for the first quarter of 2022.

- Foreign Remittance flows in May 2022 totalled USD 339.7 million compared to USD 315.8 million in May 2021, a 7.6 percent increase. The cumulative inflows for the 12 months to May 2022 totalled USD 3,992 million compared to USD 3,365 million in the same period in 2021, an increase of 18.6 percent. The strong remittance inflows continue to support the current account and the stability of the exchange rate. The US remains the largest source of remittances into Kenya, accounting for 57 percent in May 2022.

- During the week, the government gave Unga producers a massive subsidy that will see the price of Unga reduce to Sh 100 per pack till the end of election time. This is good news for NSE listed companies like Unga group as they get demand for their products since the price will be pocket friendly for a majority of their customers.

- On Monday 18 July 2022, Alphabet Inc (Google) 20 for 1 share spilt took effect. This saw those who had Google shares on 15 July 2022, get 19 free shares for each Google share they had. This automatically meant the share price of Google reduced by a massive 95% to around $113 per share. This is a pocket friendly price and moving forward you should consider having Google as part of your portfolio since its a good cash generating machine and clearly undervalued given historical standards.

- BAT Kenya reported a 12.36% growth in turnover to KES 14.09 billion for the period ended 30 June 2022 compared to KES 12.54 billion for period ended 30 June 2021. Profit after tax for the six months of the year was KES 2.93 billion which is over 8.41% higher than KES 2.70 billion during the same period previous year. Its earnings per share increased from KES 26.98 for period ended 30 June 2021 to KES 29.25 for period ended 30 June 2022. Its book value per share decreased from KES 149.74 for period ended 30 June 2021 to KES 129.10 for period ended 30 June 2022. Return on average equity for the company decreased from 48.23% in 2021 to 41.96% in 2022. Given the above the justifiable valuation for each share of BAT Kenya is KES 518.00 per share.

- CIC insurance holdings is finding it hard to sell its 200 acre piece of land in Kahawa West Nairobi Area. This is even after sub dividing the piece of land into plots of ¼ an acre each. A quarter a plot goes for KES 7 million in the area. The company had projected it will take two years to complete the sale of the land. This is bad for the company since it will be forced to borrow to finance its working capital needs.

- Hon Dr. Catherine Kimura was elected as the Chairman of the Board of Directors of Kenya Reinsurance Corporation Limited effective from 15 July 2022. She is a specialist in Public Finance and policy and management with over 37 years experience. She has held various positions in the government and was the first chancellor of Multi Media University and she has also worked as a Project Coordinator with the Nairobi City Council Financial Management Oversight Board. Lastly she a former director of NSE listed KCB Group.

- United Kingdom inflation hit a 40 year high of 9.4% in June 2022 compared to 9.1% in May 2022. This increases the possibility of the Bank of England acting forcefully by hiking the key rate to cool down inflation in the UK. It also has implication of strengthening the Sterling pound against other currencies due to interest rate hikes. This though the risk of pushing the UK economy into a recession due to high interest rates.

- Fahari real estate units get tax waiver. Previously they were forced to part with 10% of rental income as withholding tax which was submitted to the Kenya Revenue Authority by the respective tenants in the four major buildings owned by Fahari I-Reit. This means, rental income will get a 10% moving forward.

- Nine publishers won a tender to supply Grade Seven books to the government for the year 2023. It is worthy to note that, Longhorn Publishers secured a tender to supply French books and Computer books which have been listed as optional subjects under CBC.

- Safaricom paid International Financial Corporation KES 474 million for various advisory services related to its entry in Ethiopia. The company also took a loan of $400 million (KES 46.3B) from Standard Chartered bank to help it meet the cost of acquisition for its Ethiopian license. Safaricom and its consortium partners, had paid a total of $850 million( KES 100.8B) for the license fee.

- Airtel Kenya spilt its mobile money arm from its other business lines. Its mobile money will be operated in a separately run entity called Airtel Money Kenya. The new entity took over the firm’s mobile money services effective from Thursday 21 July 2022. Though run separately, the two companies will continue sharing customer data with usage of airtel money services being proof of acceptance of the sharing of your data. The spinoff comes after London listed Airtel Africa PLC sold a 25.77% percent stake in its local mobile money business as part of a continental deal that has seen it raise $550 million (KES 65.2B) from four institutional investors. Airtel rival Safaricom PLC is unlikely to follow suit though since it still considers its mobile money M-PESA unit as a critical part of its business. Our view though, Safaricom should consider a spinoff of M-PESA since it could lead to a higher valuation for the business as a standalone as compared when they are joined together with its voice business. Moreover a spinoff of MPESA implies that Safaricom will be in a position to roll out more products like wealth management and insurance products.

- The International Monetary Fund Said that Safaricom M-PESA and commercial banks should be shielded from competition when the Central Bank of Kenya rolls out its Central Bank Digital Currency (CBDC). This is because it will lead to bypassing of the traditional middlemen like banks and M-PESA and Central Bank can transact directly with individuals.

- Somalia wants to be part of the East African Community. If this is achieved, it could most likely push the GDP of the EAC to above KES 30 trillion after the inclusion of DRC pushed it to KES 29 trillion marks.

- South Africa Central bank has unveiled the biggest increase in interest rates in last 20 years in an attempt to cool down inflation. The South African Reserve bank hiked its main benchmark rate by 0.75% to 5.50 percent on Thursday 21 July 2022. We expect the Central Bank of Kenya to follow suit when it holds its MPC meeting on Wednesday 27 July 2022. This is likely to slow down economic growth and maybe recessionary.

- Equity Bank signed a memorandum of understanding (MoU) with the East African Community (EAC) for SME financing to help it fast track its Africa resilience and recovery plan that largely targets small and medium enterprises (SMEs). Equity is setting aside part of its $13 billion balance sheet available to the region entrepreneurs. It’s also raising funding from Various development financiers including the International Finance Corporation, African Development Bank and other European-based lenders.

- Equity bank signed a memorandum of understanding with the African Continental Free Trade Area Secretariat that could see Equity Bank set aside $6 billion to finance the primary sectors of food and agriculture, extractives, manufacturing and logistics, trade and investments, social impact, health and environmental investments as well as technology enabled economy to accelerate economic recovery and resilience of the African continent.

- The European Central Bank, hiked its key refinancing rate by 0.5% against the expected 0.25% hike to 0%. This was an attempt to cool inflation in the European Union and also to try to play catch up with other Central Banks that have hiked their key rates by a larger margin. This is likely to see the strengthening of the Euro against other currencies like the US dollar. However it risks pushing the EU economy into a recession at a time when the EU is facing the Ukrainian versus Russian war.